Maximum amount i can borrow mortgage

Compare Offers Side by Side with LendingTree. Check Eligibility for No Down Payment.

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

Conforming conventional loans are subject to Fannie Mae and Freddie conforming loan limits.

. Get Started Now With Rocket Mortgage. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford. Ad More Veterans Than Ever are Buying with 0 Down.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. What is your maximum mortgage loan amount.

Let your total annual housing expenses and other monthly debts be 500 and 200 respectively. Its A Match Made In Heaven. See If You Qualify for Lower Interest Rates.

First time buyers can take out a mortgage of up to 90 of the purchase price of a home. Mortgage Do S And Don Ts Mortgage Mortgage. 340600 x 60.

How much can you borrow. Were Americas 1 Online Lender. You can usually only borrow up to 85 of the equity you have in your home.

Principal Limit MCA x PLF. Ad More Veterans Than Ever are Buying with 0 Down. Lenders will typically use an income multiple of 4-45 times salary per person.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. This maximum mortgage calculator collects these important variables. How Many Times My Salary Can I Borrow For A Mortgage.

Ad Check FHA Mortgage Eligibility Requirements. Ad FHA VA Conventional HARP And Jumbo Mortgages Available. Compare Mortgage Options Get Quotes.

Get the Right Housing Loan for Your Needs. 650000 x 524. If you want a HECM the maximum amount you can obtain is constrained by the median home price in the area where you live but the absolute maximum amount you can.

When arranging mortgages we need to. The maximum amount you can borrow may be lower depending on your LTV and following our assessment of your personal circumstances. Compare Your Options Get Your Rate.

Check Eligibility for No Down Payment. The maximum amount you can borrow may be lower depending on your LTV and following our. This article explains how mortgage lenders determine the maximum amount you can borrow based on your income.

Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. Whatever you dont use in your credit line will keep. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

These limits enable qualified borrowers in most areas to get a mortgage of up to 647200 for. Home equity is the difference between what you owe on your mortgage and what your home could sell for on the current market. The maximum amount you can borrow with a.

Discover 2022s Best Mortgage Lenders. Ad Compare Your Best Mortgage Loans View Rates. Our mortgage calculator can give you a.

Instead it means that if you default on a loan thats under 144000 we guarantee to your lender that well pay them up to. Proceeds Year 1 Principal Limit x 60. The 36000 isnt the total amount you can borrow.

Weekly and fortnightly repayment calculations if your monthly repayments are 1000 fortnightly repayments are calculated by dividing 1000 by 2 1000 2 500 and weekly repayments. However even with that 85 cap. As a general rule age is the primary factor that determines your reverse mortgage maximum loan amount.

Ad It Only Takes 3 Minutes To Get Pre-Approved. However even with that 85 cap the actual amount that you as an. You cant borrow as much as you want with a home equity loan.

That largely depends on income and current monthly debt payments. The solution below shows how much money he can get in year one. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

60-year-olds are likely to borrow. Apply Online Get Pre-Qualified Today. Online Mortgage Advisor though.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. For example if you earn 30000 a. You can use a credit line growth feature that allows you to borrow some money now and leave some credit available for the future.

Ad Looking For A Mortgage. Second time buyers can take out a mortgage of up to 80. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Now say the mortgage rate is 4 and you want to take out a mortgage loan with a term period. See Todays Rate Get The Best Rate In A 90 Day Period.

A Little Cheat Sheet To Help You When Buying A Home Call Me When You Re Ready Or Have Any Questions Remax Home Buying Things To Sell

Real Estate 101 Word Of The Week Principal The Principal Is The Amount That You Borrow From The Lending Inst In 2022 Real Estate Terms Mortgage Payment The Borrowers

Pin On Ontario Mortgage Financing

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

Tips For Repaying Your Payday Loan Payday Loans Payday Best Payday Loans

Mortgage Tip Think Long Term Mortgage Refinance Mortgage Federal Credit Union

Private Mortgage Lenders Toronto Mortgage Lenders Lenders Mortgage

How To Calculate Annual Percentage Rate 12 Steps With Pictures Investing Borrow Money Calculator

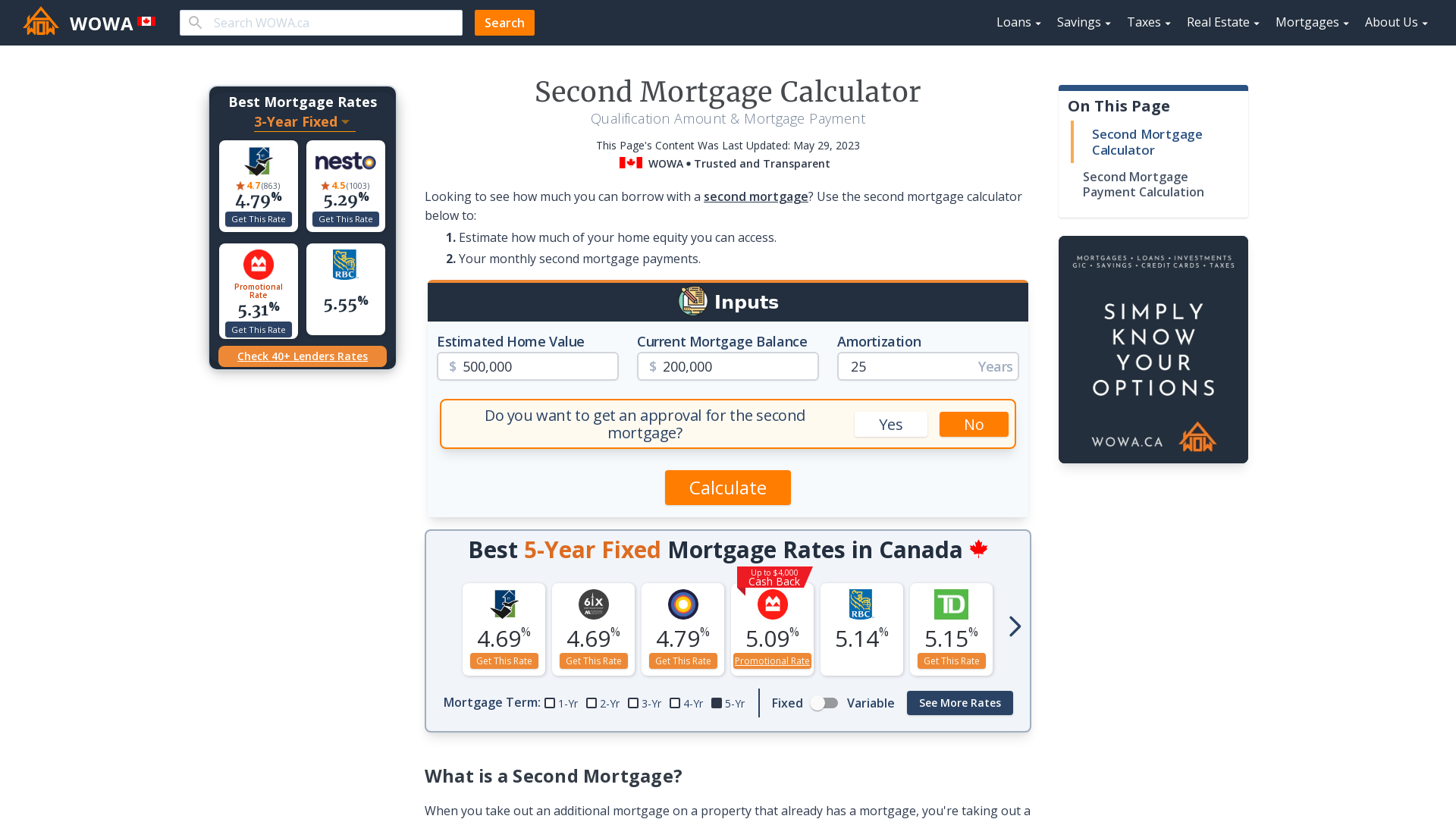

Second Mortgage Calculator Qualification Payment Wowa Ca

Pin By Cdp On Business School In 2022 Business School In High School High School

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity